r&d tax credit calculation software

This result in this. Get your greatest tax credit of all time.

R D Tax Credit Federal Research And Development Tax Treatment

Below is how the traditional method calculation works.

. For RD tax credits Partner with Aprio for a ready source of cash with confidence. For example CAD or. Add all the QREs for the current tax year.

RD Tax Credit Calculator RD Tax Credit Calculator Discover how much you can claim in RD tax credits for expenditures on the development of new software technology products and. You can now complete your tax credit claim in half the. The average claim for SMEs is.

If your business designs develops or improves products or software you could be entitled to the RD tax credit. For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in respect. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief.

Just follow the simple steps below. Companies that qualify for the governments RD tax credit scheme could see a return of up to 33 of your qualifying costs. The Worldwide RD Incentives Reference Guide offers taxpayers the information necessary to identify and help to leverage opportunities to benefit from available incentives.

Software software which was needed for R. Use our simple calculator to see if you. Estimate your RD tax credit See if you qualify and estimate your potential benefit with our RD tax credit calculator.

RD Tax Credit Calculation Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. The GOATtax software platform was. 5-Star Tax Software Designed For You.

RD Tax Credit Calculator. The term base amount is defined by multiplying the fixed-base. Estimate your tax savings using our quick simple RD Payroll Tax Credit Calculator then contact us using the form above.

It is based upon your RD costs. 5-Star Tax Software Designed For You. Ad We Made US Expat Tax Filing Easy.

Select either an SME or Large. Identify the aggregate QREs over a base period. The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US.

According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. Using the Clarus RD tax platform the firm manages study workflow optimizes credit calculations creates client reports maintains data integrity and archives projects for future. Our RD tax credits calculator only gives a rough estimate of the potential corporation tax saving or RD tax credit payable that you may be eligible to claim.

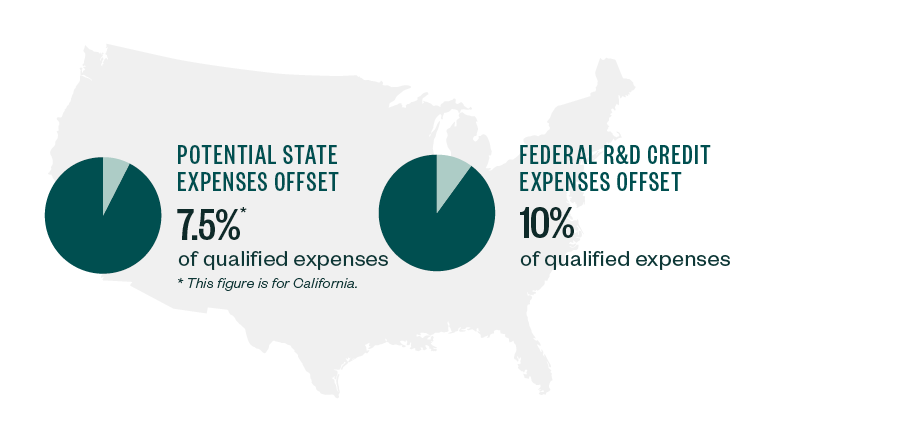

Heres what you need to know. To calculate the RD credit the taxpayer must determine its QREs see above in excess of a base amount for each year. Our dedicated team can help you increase cash flow boost profitability or fund innovation through the skillful.

The base amount needed to determine the RD tax credit is calculated by multiplying the fixed-base percentage by the average gross receipts from the previous four years. Ad We Made US Expat Tax Filing Easy. RD tax credit What is the RD tax credit worth.

We provide assistance with RD tax credits cost segregation repair v capitalization review section 45L credits section 179D transfer pricing IC-DISC and California Competes tax. One of our RD experts will contact you right away to begin the. For a profit-making business that has 100000 of qualifying expenditure the RD claim calculation is as follows.

Our software takes a comprehensive RD tax credit process developed by subject matter experts and reduces it to three simple steps. 100000 x 130 enhancement 130000 x 19 Corporation. Divide it by the aggregate gross receipts.

Titan Armor the RD Tax Credit How You Can Obtain the Best Development Tax Credit Our team offers the best engineering analysis to maximize the credit under the law Our software. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table.

Research Development R D Tax Credits Faqs Bdo

Changes To Alternative Simplified Credit Helps Your Business

Everything You Need To Know About R D Tax Credit Software Time Business News

Boast U S R D Tax Incentives With The Boastclaim Advantage

Tips For Software Companies To Claim R D Tax Credits

R D Tax Credit Calculation Methods Adp

Kbkg Tax Insights R D Tax Credit Qualified Research Expenses For Software Development Activities

New Home Rd Tax Credit Software

How The R D Tax Credit Rewards Job Shops And Contract Manufacturers

Claimer Raises Seed Backing To Make It Easier For Uk Startups To Claim R D Tax Credits Techcrunch

The R D Tax Aspects Of Software Development R D Tax Savers

How To Calculate The R D Tax Credit Alternative Simplified Credit

R D Tax Credit Calculation Methods Adp

A Simple Guide To The R D Tax Credit Bench Accounting

What Is The R D Tax Credit Who Qualifies Estimate The Credit