how much does a tax advocate cost

The base fees that the Department of Motor Vehicles charges include. Or it could be that your needs require.

How much does a tax advocate cost Wednesday June 8 2022 Edit.

. 26 special election for public advocate an office with an annual budget of 35 million. The average fee to prepare a nonspecific Form 1040 in 2020 was 220 according to the National Society of Accountants. What is a Tax Advocate for.

Her services mightand even so that might be a bargain. How much does an Advocate cost. Though CPA fees vary by location and expertise their tax services cost 174 per hour on average in 2020 and.

Time-based tax professional fee structure. You can call your advocate whose number is in your local directory. Newly qualified chartered tax advisers CTAs can expect an annual salary of 26000 to 36000.

For many other sorts of cases particularly tax issues an hourly fee is a typical approach to charge. For an itemized 1040 form that fee goes up to 323. How much does a tax attorney cost.

Please dont translate that to mean that an advocate will cost you a few thousand dollars. As of Thursday 18. How do I apply for a tax advocate.

A lawyer often charges between 100 and 400 per hour for their. Ad Search For Info About How much does a tax attorney cost. For an additional-rate 45pc.

Dividend tax rates are based on your highest income tax rate. We have at least one local taxpayer advocate office in every state the District of Columbia and Puerto Rico. Frequently Asked Questions on How Much Does A Tax Lawyer Cost in 2022.

In general legal work isnt cheap. According to a survey by Martindale-Avvo a legal marketing and directories firm tax attorneys charge 295 to 390 per hour on average. The cost of your tax attorney will be based on the reason why you need a tax lawyer type of case the level of experience your.

Waiting since I25 have. California Highway Patrol CHP fee. A higher-rate 40pc taxpayer receiving 6000 a year would pay an additional 400.

It will cost the city as much as 23 million to conduct the Feb. We guarantee to identify at least 10000 in missing or potential business tax deductions you are not currently taking or. Can the help find out info about refunds.

1 10000 Guarantee Terms Conditions. Tax relief professionals charge fees for their services. Ad BBB Accredited A Rating.

End Your IRS Tax Problems - Free Consult. You can also call the. There is at least one Local Taxpayer Advocate in each state as well as in Puerto Rico and the District of Columbia.

The way they calculate and assess these fees vary widely by organization as noted below. What do they do.

Taxpayer Advocate Service Linkedin

What Is A Taxpayer Advocate And Should You Contact One

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Taxpayer Advocate Service Linkedin

Irs Hitting You With A Fine Or Late Fee Don T Fret A Consumer Tax Advocate Says You Still Have Options

Trying To Call The Irs Is Nearly Impossible Right Now Here S What To Do Forbes Advisor

How Much Does A Tax Attorney Cost Cross Law Group

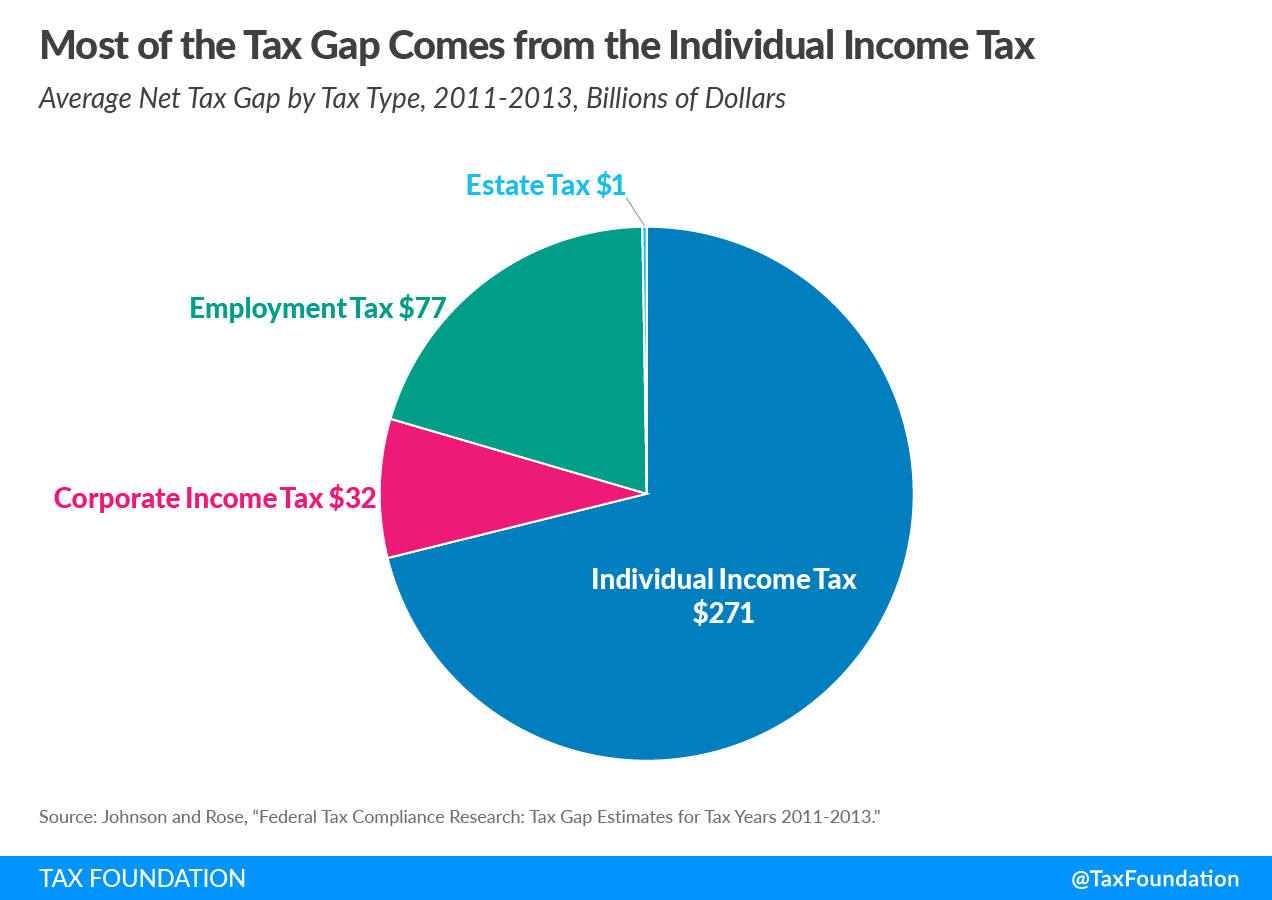

The Tax Gap Simplifying The Tax Code And Reducing The Tax Gap

Tax Advocate India Income Tax Lawyer Consultant Delhi Taxation Law Firm

Tax Consultant Pricing How Much Do Tax Consultant Services Cost Ionos

Tax Day 2022 How To Get A Bigger Tax Refund

Tom Yamachika 10 Million Words Honolulu Civil Beat

Irs Again Faces Backlog Bringing Refund Delays For Paper Filers

The I R S Backlog Of Unprocessed Tax Returns Has Grown To 21 Million The New York Times

Taxpayer Advocate Service Linkedin

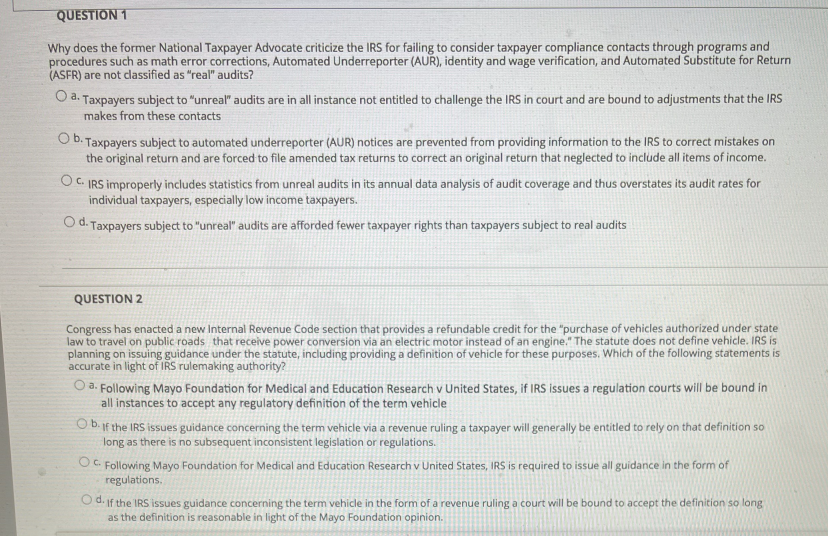

Solved Question 1 Why Does The Former National Taxpayer Chegg Com